At Lansdown, we looked at our 2024 claims figures and compared them to our 2023 findings to identify the top three most common claim causes for our Blocks of Flats Insurance clients. Our insights highlight key risks and reinforce the importance of effective property maintenance for flat owners, property managers and landlords.

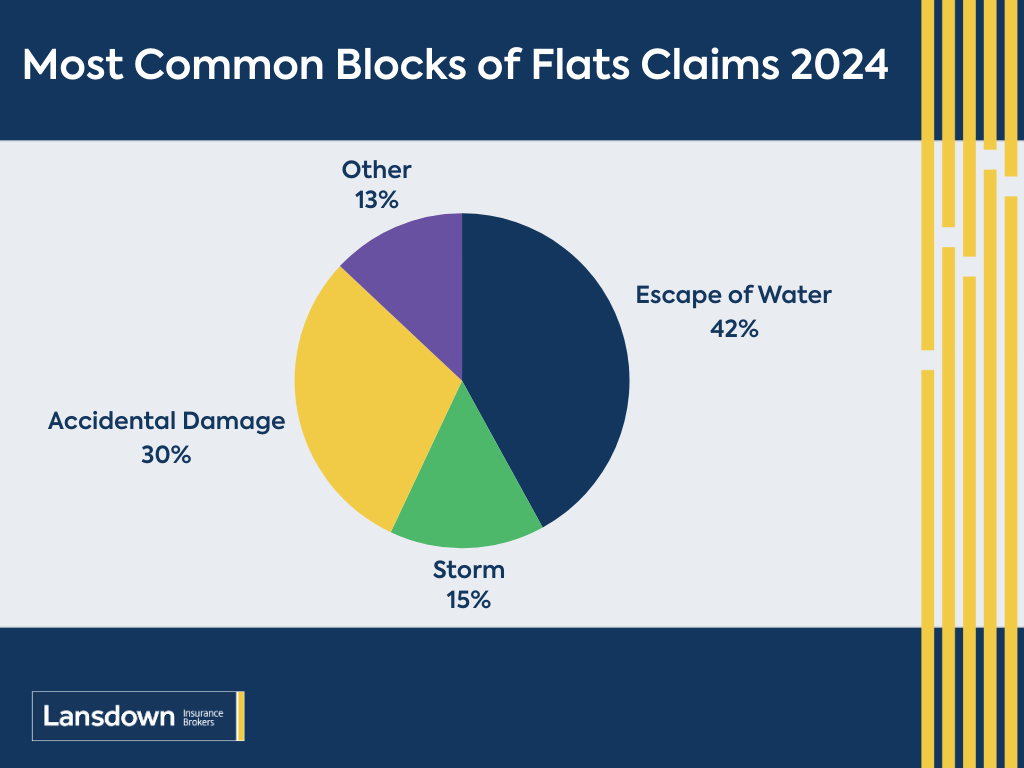

Insurance claims for blocks of flats can arise from a variety of risks, but certain types of claims occur far more frequently than others – here’s what we found…

Burst pipes and water leaks (referred to as “Escape of water” in insurance terms)

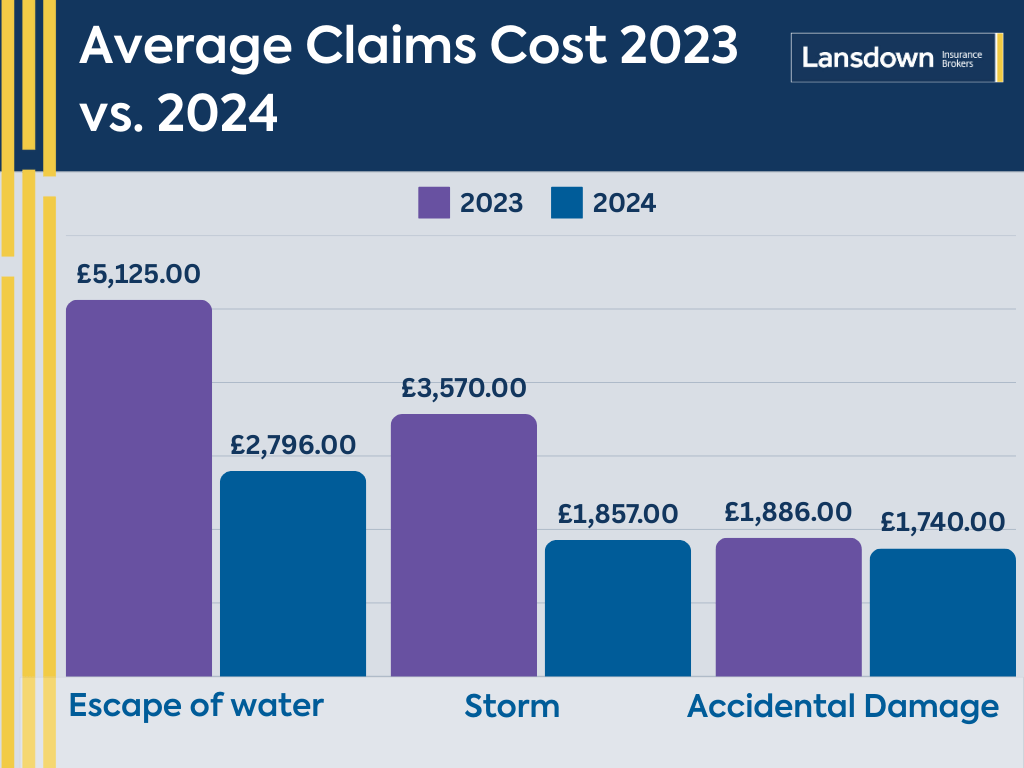

Escape of water remains the most common claim, accounting for 42% of reported cases in 2024. However, despite its frequency, the total cost of claims has significantly reduced by nearly 45%, from £5,125 in 2023 to £2,796 in 2024.

Leaking pipes, burst plumbing, and faulty appliances are the primary culprits behind these incidents, often leading to extensive property damage. The decrease in overall claim costs suggests that flat owners and landlords may be adopting better maintenance strategies, upgrading plumbing systems, or encouraging faster reporting of leaks—preventing small issues from escalating into major claims.

Accidental Damage

Accidental damage accounted for 30% of claims in 2024, making it the second most frequent type of claim. This category includes damage caused by residents, maintenance work, or unforeseen accidents such as broken windows, damage to fittings and fixtures or ingress of water from a roof for example.

While accidental damage claims remain relatively stable, the average cost of claims saw a slight decline of around 8%, dropping from £1,886 in 2023 to £1,740 in 2024. This drop is likely due in part to the more settled weather conditions, as fewer severe storms reduced incidents of water ingress through roofs—one of the common causes of accidental damage claims. Though such incidents are difficult to eliminate entirely, both landlords and flat owners may benefit from routine property inspections and prompt repairs to minimise risks.

Storm Damage

Storm-related claims made up 15% of claims in 2024, showing the continued impact of extreme weather conditions. However, despite remaining in the top three, the average claim cost dropped significantly—by almost 48%—from £3,570 in 2023 to £1,857 in 2024.

While improved weatherproofing, inspections and maintenance likely played a major role in reducing claim costs, due to the kinder weather conditions in 2024 compared to 2023 could have also contributed.

The severity of storms in late 2023 brought widespread flooding, power outages, and infrastructure damage, with intense rainfall and strong winds causing major disruptions. In comparison, while 2024 saw a higher number of named storms, the overall impact per storm was less severe than those in 2023. A lower frequency of flood claims also helped keep the average costs down, as these tend to be among the most expensive losses.

Managing risks and reducing claims

Property owners can take several steps to minimise these risks:

- Regular inspections to detect issues early

- Upgrading plumbing to modern, leak-resistant appliances and systems

- Ensuring tenants report issues promptly

- Keeping up with weatherproofing to safeguard against storms – you can find more tips in our storm and flood guidance blog

- Reviewing insurance policies to ensure adequate cover is in place

Understanding the most common claims allows landlords and flat owners to be proactive in maintaining their properties and reducing potential financial losses. With the right preventative measures in place, property owners can better safeguard their investments and reduce the likelihood of costly insurance claims.

Darren Bee, Associate Director at Lansdown, commented:

“It’s reassuring to see a decline in claim costs across key areas, which suggests that property owners are taking proactive steps in maintenance and risk prevention. However, the high number of claims highlights the continued importance of having comprehensive insurance cover tailored to the specific needs of flat owners and landlords.”

About Lansdown Insurance Brokers

Lansdown Insurance Brokers are specialists in Landlord Insurance and Block of Flats Insurance. We can provide flexible policies to suit our client’s needs. Whether you’re a landlord, letting agent, or property owner call the team on 01242 524498 or email enquiries@lansdowninsurance.com.

Lansdown is part of the Benefact Group, a charity-owned, international family of financial services companies that gives all available profits to charity and good causes.