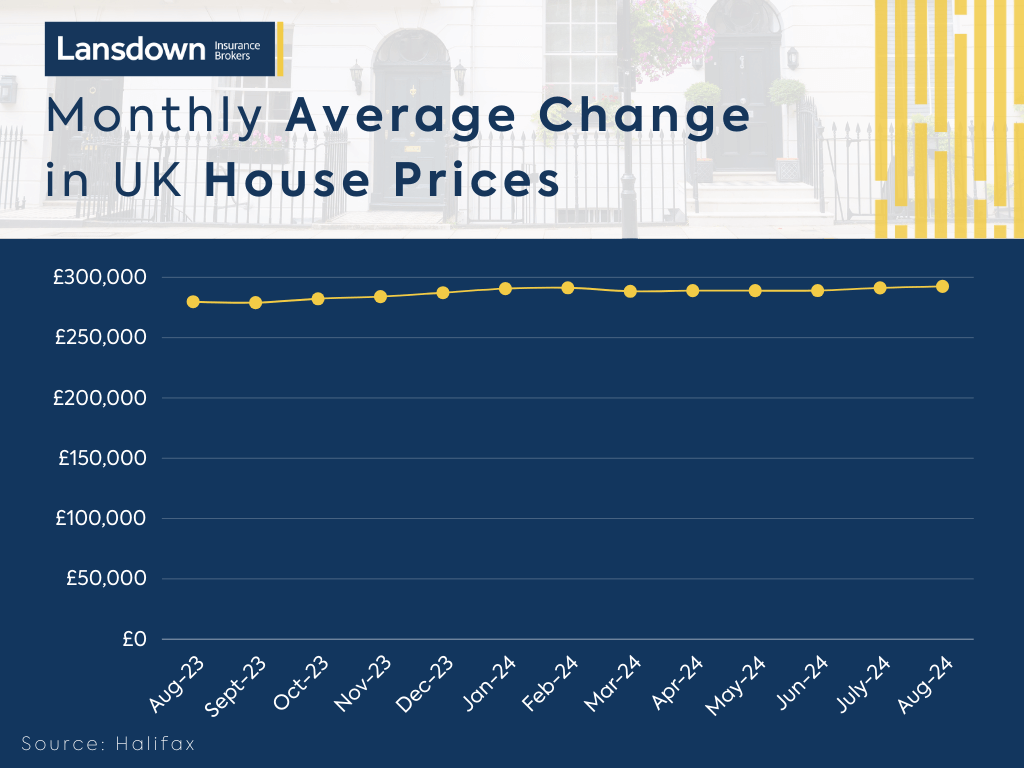

The August 2024 Halifax House Price Index paints a picture of steady growth in the UK housing market, with property values continuing their upward trajectory. House prices rose by 0.3% in August, building on the 0.9% increase recorded in July. The average property price now stands at £292,505, which marks the highest point since August 2022 and is just £1,000 short of the all-time high recorded in June 2022.

The Landlord Insurance team at Lansdown have summarised the significant changes and what the latest figures mean for property owners and potential buyers.

Key Market Insights:

Annual Growth Rate: House prices have grown 4.3% year-on-year, the strongest rate of annual growth since November 2022. However, this robust growth is partly due to a weaker market performance in the previous year, which makes the current figures appear more favourable in comparison.

Regional variations:

- Northern Ireland leads the UK with the most significant annual house price growth, recording a 9.8% increase, pushing the average price there to £201,043

- Wales followed closely, with prices rising by 5.5%, bringing the average cost of a property to £224,433

- In Scotland, prices increased more modestly, with a 1.7% annual rise, putting the average property price at £205,144

- The North West of England experienced a 4.0% annual growth, with homes now averaging £232,917

- London, while continuing to have the highest average property prices at £536,056, saw a relatively modest growth of 1.5% over the past year

Mortgage and Market Dynamics: The resilience of house prices in 2024 has been driven by a surge in buyer confidence, largely attributed to easing interest rates. This optimism is mirrored in mortgage approval rates, which hit their highest level in almost two years. In July, 61,985 mortgages were approved—a 2.3% increase from the previous month, and 26.5% higher than the same period in 2023. As market activity picks up, the outlook for house prices remains positive, with predictions of modest growth for the rest of the year.

Affordability Challenges: Despite the upward trend in house prices, affordability remains a concern, particularly for first-time buyers grappling with the impact of higher mortgage costs. While current homeowners may benefit from increased property values, the challenge of purchasing remains significant for many potential buyers.

Housing Activity: The housing market has shown resilience, with a 6.7% year-on-year increase in sales activity, although transactions in July 2024 saw a slight 0.6% dip compared to June. However, quarterly figures show a 5.1% increase in sales compared to the previous three months, indicating that the market is picking up momentum.

What Does This Mean for Property Owners and Investors?

For existing homeowners, the ongoing price growth represents an opportunity to build equity. However, for those looking to enter the market, the continued rise in property values and mortgage costs underscores the importance of careful financial planning.

For more detailed information on the Halifax House Price Index and to stay updated on future market trends, visit: Halifax House Price Index.

About Lansdown Insurance Brokers

Lansdown Insurance Brokers are specialists in Landlord Insurance and Block of Flats Insurance. We can provide flexible policies to suit individual client needs and provide advice on what cover is required. For more information call the team on 01242 524498 or email enquiries@lansdowninsurance.com.

Lansdown is part of the Benefact Group, a charity-owned, international family of financial services companies that gives all available profits to charity and good causes.