The Halifax House Price Index for June 2024 provides a snapshot of the current UK property market, showing stability in house prices alongside notable regional variations. Our Landlords Insurance and Home Insurance team at Lansdown Insurance Brokers have summarised the significant changes and what the latest figures mean for property owners and potential buyers.

Key Findings

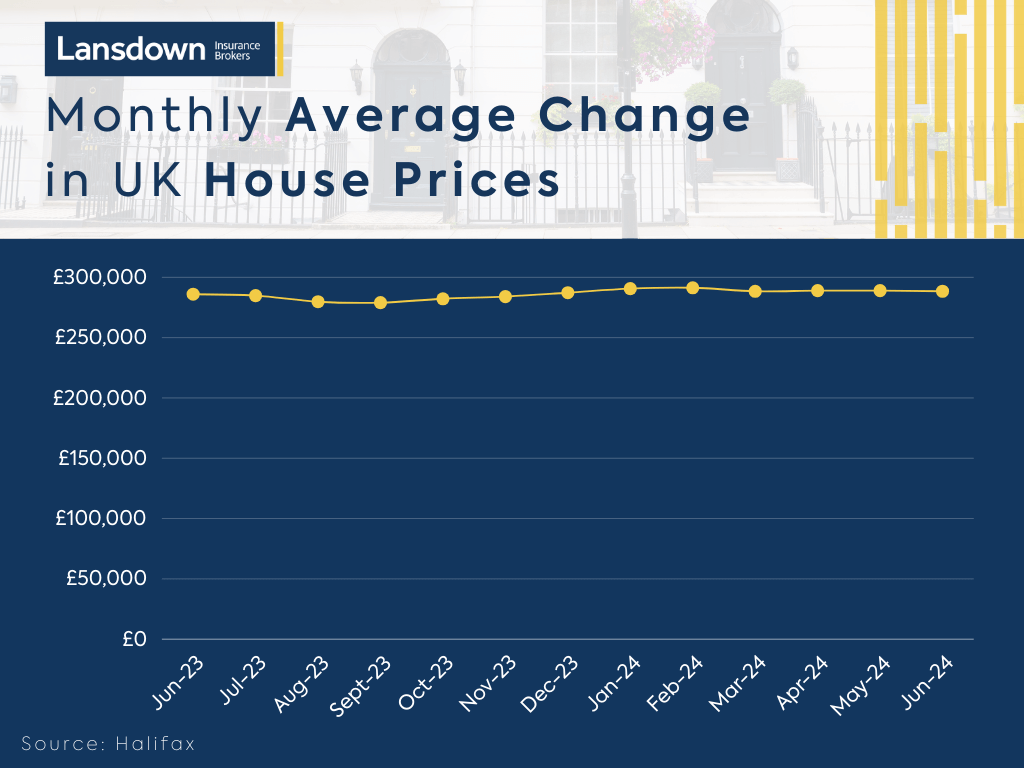

In June 2024, UK house prices experienced a slight decrease of 0.2%, bringing the average property price to £288,455. This minor movement aligns with the stable pattern observed over the past few months. Annually, prices have grown by 1.6%, marking the seventh consecutive month of growth, reflecting the market’s resilience against economic pressures.

Regionally, Northern Ireland leads with a 4.0% annual growth, pushing average prices to £192,457. North West England follows with a 3.8% increase, and Scotland and Wales also saw positive growth. Conversely, Eastern England is the only region experiencing a decline, with a 0.9% drop in average prices. London remains the UK’s most expensive region, with prices up by 0.9% to £536,306.

The housing market’s subdued state is primarily due to limited property supply rather than reduced demand. Despite higher interest rates affecting mortgage affordability, there is cautious optimism that future reductions in rates and rising incomes could ease these challenges.

Economic indicators show resilience, with property transactions in May 2024 up by 2.4% from April and 17.2% higher than the previous year. While mortgage approvals slightly decreased month-on-month, they remained significantly higher than last year, indicating continued interest in property purchases.

Implications for Homeowners and Buyers

For homeowners in regions with rising prices, there’s positive news in terms of property value appreciation. Those in areas with declining trends, like Eastern England, should reassess their property values and ensure their insurance cover is accurate.

Prospective buyers face challenges with affordability and need to consider regional price trends carefully. Regions with strong growth may offer better long-term value, but navigating the current market requires careful financial planning.

From an insurance perspective, stability in house prices emphasises the importance of regularly reviewing policies to ensure adequate protection. Higher-growth regions may require rebuild cost adjustments to reflect increased property values.

Looking Ahead

The Halifax report anticipates modest price increases through 2024 and into 2025, contingent on economic conditions and interest rates. The ongoing balance between supply, demand, and broader economic factors will continue to shape the housing market’s future.

For more information and updates, visit the Halifax House Price Index.

About Lansdown Insurance Brokers

Lansdown Insurance Brokers are specialists in Landlords Insurance, Block of Flats Insurance and Home Insurance. We can provide flexible policies to suit individual client needs and provide advice on what cover is required. For more information call the team on 01242 524498 or email enquiries@lansdowninsurance.com.

Lansdown is part of the Benefact Group, a charity-owned, international family of financial services companies that gives all available profits to charity and good causes.