Understanding who is responsible for arranging buildings insurance for a block of flats can be confusing…

Whether you’re a leaseholder, a tenant, a landlord who owns one or more flats in a block, or the freeholder of a block of flats, it’s important to be clear on your rights and responsibilities.

To help, we’ve produced a new series of guides which clearly explain the key things you need to know, including information on recent changes that may impact you.

- If you’re a freeholder, find out more about your responsibilities in our “Is the freeholder responsible for buildings insurance for a block of flats?” guide here.

- Do you own a flat on a leasehold basis or rent a flat? Read our guide to buildings insurance for tenants and leaseholders here.

- Are you a landlord who owns one or more flats in a block? Our “Does the landlord pay for buildings insurance in a block of flats? A guide to flat insurance for landlords” explains the key things you need to know here.

Are you responsible for buildings insurance for a block of flats?

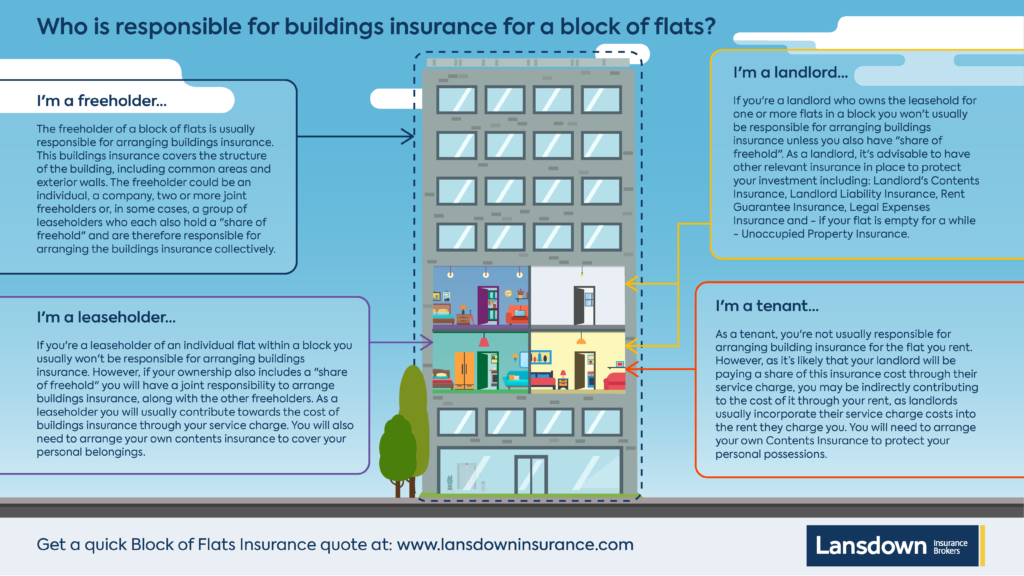

As well as the new useful guides above, we’ve also produced the handy at-a-glance visual guide below which summarises who is responsible for buildings insurance for a block of flats. Simply click on the image to zoom in.

You can also download a copy of the visual guide here. We recommend reading the full guides above for more information, though.

Need more advice?

If you’re still not sure if you’re responsible for buildings insurance for your block of flats, or have another question related to block of flats insurance, our experienced team would be happy to answer any questions you have. At Lansdown Insurance Brokers, we’ve been providing block of flat insurance for over 20 years. We work closely with freeholders, property managers, and Residents Management Companies to ensure the right cover is in place, at a competitive price.

We can help you navigate the legalities, ensure compliance with MOBI rules, and find the best possible deal for your block of flats. Get in touch with our expert team to find out more.