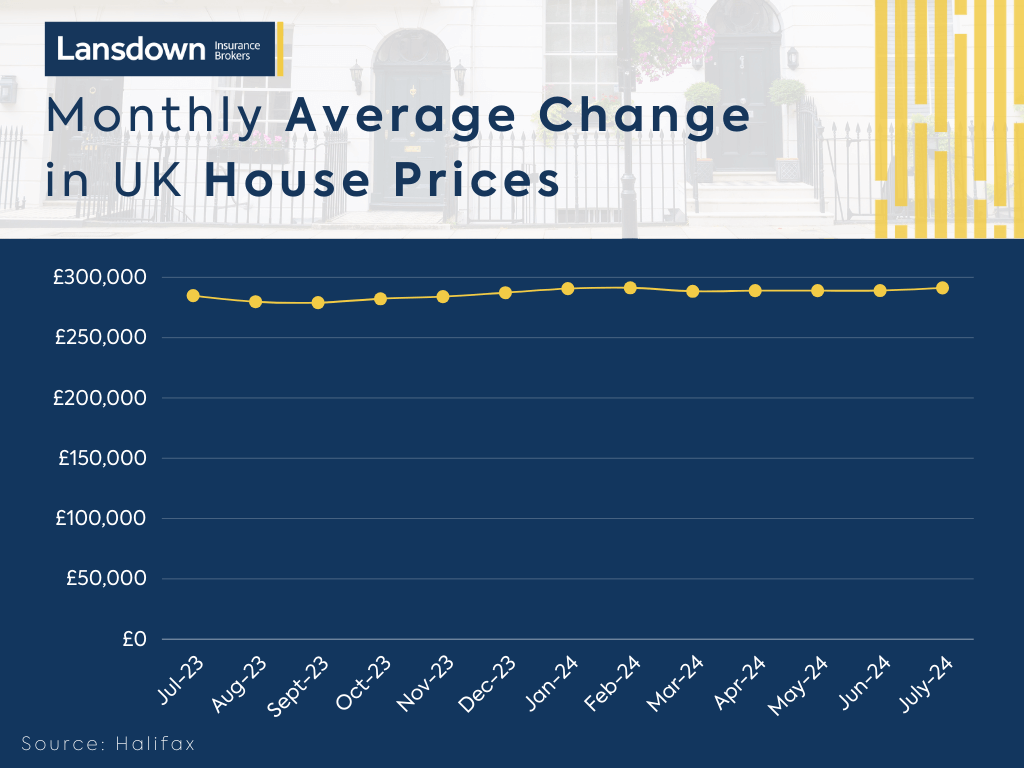

The latest Halifax House Price Index for July 2024 reports a noticeable increase in UK house prices. This rise follows a period of relatively stable prices and reflects a modest yet significant upward trend in the housing market. Our Landlord Insurance and Home Insurance team at Lansdown Insurance Brokers have summarised the significant changes and what the latest figures mean for property owners and potential buyers.

Key Highlights

In July, UK house prices rose by +0.8% following three months of minimal changes. This increase brings the annual growth rate to +2.3%, marking the highest rate since January 2024. The typical property now costs £291,268, up from £289,042 in June.

Regionally, Northern Ireland continues to record the strongest annual house price growth in the UK, rising by +5.8%. This is up from +4.1% the previous month and is the highest increase since February 2023, with the average price of a property now at £195,681. In contrast, Eastern England saw a slight annual decrease of -0.4%, with properties now averaging £330,282.

Monthly and Quarterly Changes

The average UK house price increased by over £2,200 compared to the previous month. The quarterly change remained flat at 0.0%, indicating stability in the market over the three-month period.

Market Influences

Amanda Bryden, Head of Mortgages at Halifax, highlighted that the recent cut in the Bank of England’s Base Rate, alongside reductions in mortgage rates, has been encouraging for prospective buyers and those looking to remortgage. However, challenges such as affordability constraints and limited property availability continue to impact the market.

Housing Activity

- According to HMRC, UK home sales decreased by -0.6% in June compared to May, though quarterly transactions were +7.3% higher than the preceding three months.

- Mortgage approvals saw a small decline of -0.3% in June 2024, according to Bank of England data. Despite this, the figure is +11.7% higher year-on-year.

- The RICS Residential Market Survey indicated a subdued market, with new buyer enquiries and agreed sales showing slight improvements but remaining in negative territory.

Future Outlook

Given the backdrop of lower mortgage rates and potential further reductions in the Base Rate, the expectation is for house prices to continue their modest upward trend throughout the remainder of the year. However, affordability issues and the limited supply of properties are likely to keep the market competitive and challenging for buyers.

For more detailed information on the Halifax House Price Index and to stay updated on future market trends, visit Halifax House Price Index.

About Lansdown Insurance Brokers

Lansdown Insurance Brokers are specialists in Landlord Insurance and Block of Flats Insurance. We can provide flexible policies to suit individual client needs and provide advice on what cover is required. For more information call the team on 01242 524498 or email enquiries@lansdowninsurance.com.

Lansdown is part of the Benefact Group, a charity-owned, international family of financial services companies that gives all available profits to charity and good causes.