In the dynamic landscape of the UK property market, April offered a semblance of stability, as indicated by the latest Halifax House Price Index.

Our Landlords Insurance and Home Insurance team at Lansdown Insurance Brokers have summarised the significant changes in the property market impacting homeowners and property professionals. Take a look at our key findings here:

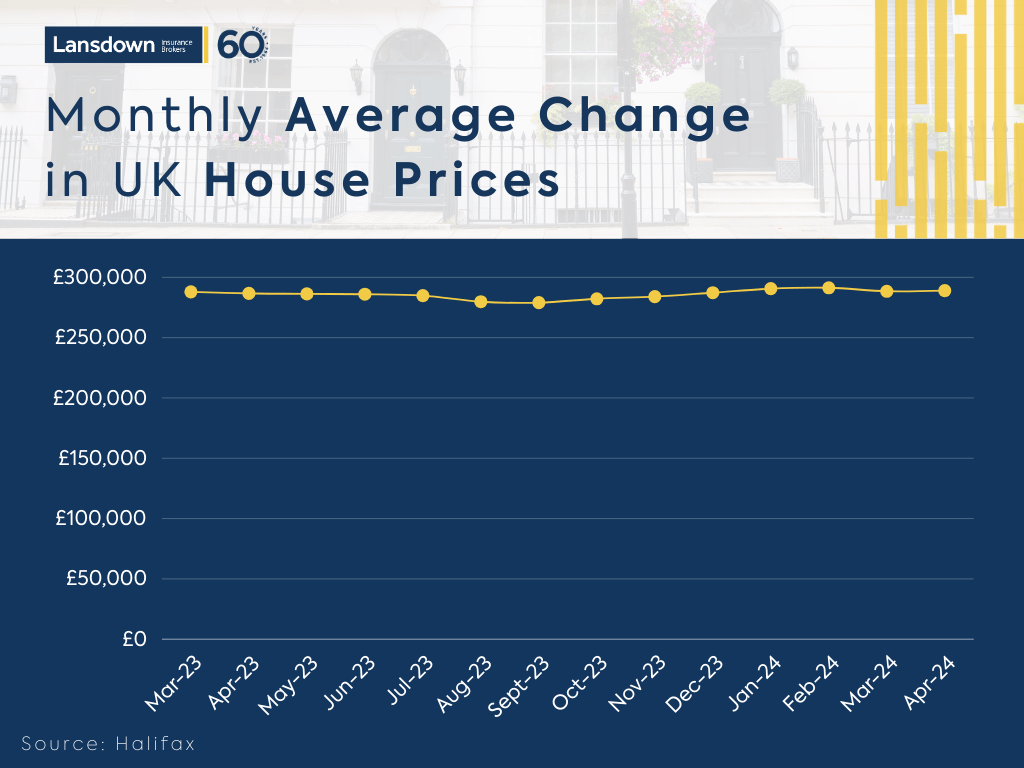

Monthly Movement: Despite a 0.9% decline in March, UK house prices remained resilient, nudging up by a mere 0.1% every month. While this increase may seem modest, it underscores the market’s ability to adapt amidst ongoing economic changes and policy adjustments. The average house price in the UK saw a rise in April, reaching £288,949 compared to £288,781 the previous month.

Annual Growth: Despite monthly fluctuations, the annual growth rate of house prices surged to 1.1%, an improvement from the 0.4% recorded in March. This boost can be partly attributed to the base effect of weaker price growth during the same period last year.

Regional Variances: Northern Ireland emerges as the strongest performing region, with a robust annual growth rate of 3.4% in April. Meanwhile, the North West of England leads growth within England, with prices up by 3.3% annually.

Challenges Ahead: Affordability constraints continue to pose challenges for both new buyers and those coming off fixed-term deals. Mortgage rates have seen a recent uptick, largely influenced by expectations surrounding future Bank of England base rate changes.

Insights from Amanda Bryden, Head of Mortgages, Halifax said:

“The average property now costs £288,949, compared to £287,244 at the start of the year. While there is always much scrutiny of monthly price changes – and a degree of volatility is to be expected given current market conditions – the reality is that average house prices have largely plateaued in the early part of 2024.

“This reflects a housing market finding its feet in an era of higher interest rates. While borrowing costs remain more expensive than a few years ago, homebuyers are gaining confidence from a period of relative stability. Activity and demand is improving, evidenced by greater numbers of mortgage applications so far this year, while at an industry level mortgage approvals have reached their highest point in 18 months.

“Our recent research also found that buyers are adjusting their expectations, with first-time buyers in particular compensating for higher borrowing costs by targeting smaller properties. We see this reflected in property prices for the first few months of this year, with the value of flats rising most sharply, closing the ‘growth gap’ on bigger properties that’s existed for most of the last four years.

“However, we can’t overlook the fact that affordability constraints are still a significant challenge, for both new buyers and those rolling off fixed-term deals. Mortgage rates have edged up again in recent weeks, primarily as a result of expectations around future Bank of England base rate changes, with markets now pricing in a slower pace of cuts.

“If, as is still expected, downward moves in Bank Rate come into play later this year, fixed mortgage rates should fall. Combined with the resilience displayed by the housing market over recent months, we now expect property prices to rise modestly over the course of 2024.”

Housing Activity:

Transaction Data: HMRC’s monthly property transaction data indicates a slight uptick in UK home sales in March 2024 compared to the previous month. Year-on-year transactions, however, remain lower than March 2023 figures.

Mortgage Approvals: The latest figures from the Bank of England reveal an increase in mortgages approved for house purchases in March 2024, indicating sustained demand in the market.

Market Sentiment: The RICS Residential Market Survey for March 2024 suggests steady improvements in buyer demand and new listings, reflecting cautious optimism among industry professionals.

About Lansdown Insurance Brokers

Lansdown Insurance Brokers are specialists in Landlords Insurance, Block of Flats Insurance and Home Insurance. We can provide flexible policies to suit individual client needs and provide advice on what cover is required. For more information call the team on 01242 524498.

Lansdown is part of the Benefact Group, a charity-owned, international family of financial services companies that gives all available profits to charity and good causes.